because late October 2008, I have been arguing that the leading goal of the Fed's Quantitative Easing software changed into no longer to give monetary stimulus, but quite to fulfill very strong funds demand. I've fleshed out the argument again and again over the years, with a couple of examples here, right here, and right here.

a short version of the argument goes like this: The proper goal of Quantitative Easing changed into no longer to "print funds." as an alternative, it changed into to transform notes and bonds into financial institution reserves (now without difficulty T-bill equivalents, considering the fact that they pay hobby) in an effort to meet the economic climate's colossal demand for liquid, default-free, unique-bearing securities. QE dramatically expanded the provide of "cash" at a time when the market's demand for funds was just about insatiable. Milton Friedman taught us that inflation results when the deliver of cash exceeds the demand for it. The evidence to date speaks for itself: we've viewed no boost in inflation regardless of a giant raise in the financial base, so it must be the case that QE served specifically to provide cash that the market desired to cling.

In any adventure, QE could certainly not be stimulative, since you can not extend the output of an economic system through increasing its give of funds; pumping cash into an economic system in extra of what is demanded effortlessly serves to inflate the rate degree. So it makes little or no feel to argue that the Fed (or some other central bank that has engaged in QE) is powerless to stimulate the economic climate. QE wasn't a failure, it became fully imperative, and it labored: if the Fed hadn't undertaken QE, there would had been a serious scarcity of money, and that could have extended the recession and created lots of deflation.

QE became a response to whatever that brought on an immense demand for funds, and that "anything" was an enormous shock to self belief. fearful of the prospect of one other financial market meltdown and a different international recession, americans - and particularly banks - desired a secure vicinity to cover, and there have been no longer sufficient T-expenses to head round on the time QE launched. (do not forget that with the aid of June 2008 the Fed had sold virtually all of its holdings of T-bills in response to the market's demand for them.) furthermore, within the years following the outstanding Recession, Treasury significantly decreased its issuance of T-bills in prefer of longer-time period securities in a rational response to the historically low level of Treasury yields.

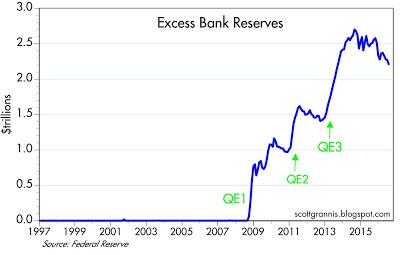

however self belief has progressively again because the financial system has recovered, it be quite doubtless that banks' urge for food for extra bank reserves will continue to be very robust as a result of multiplied regulatory necessities, as I noted earlier this year. at the least half of the $2.2 trillion of excess reserves currently held via fundamental banks likely is needed simply to meet chance-weighted capital necessities imposed by way of Dodd-Frank and the Basel Accords, plus the Fed-imposed requirement that banks hold highly liquid property (notably bank reserves) equal to one hundred% of the quantity that Fed stress exams point out they would need to continue to exist yet another liquidity disaster. As for the rest, banks are still - surely - reluctant to lend anywhere close as a lot as their considerable holdings of extra reserves would allow.

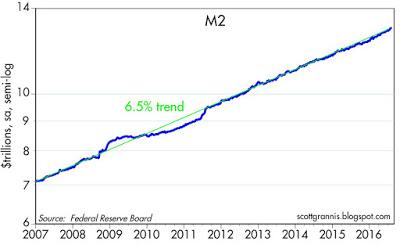

listed here are some up-to-date charts that illustrate and clarify the improved demand for funds:

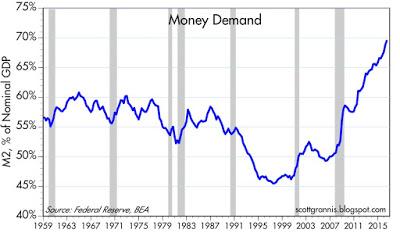

The chart above is my favourite approach to measure the demand for funds. It compares the degree of the M2 cash deliver to the stage of nominal GDP. The ratio of M2 to nominal GDP is comparable to the percentage of annual salary that the ordinary adult holds in the variety of "cash." For a long time, from 1960 in the course of the late Nineteen Eighties, this ratio become exceptionally sturdy. It declined within the 1990s because of the fallout from the S&L crisis. due to the fact 2001, although, it has risen continuously and is now at its maximum level ever.

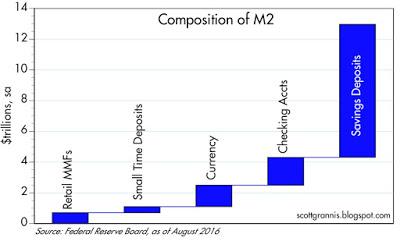

The chart above indicates the latest composition of M2: retail money market money, small time deposits, currency in circulation, retail checking money owed, and financial institution savings deposits. The mixture of these accessories has modified over time, however the sum is a pretty good illustration of the amount of enormously liquid, conveniently spendable "cash" it's held via the public.

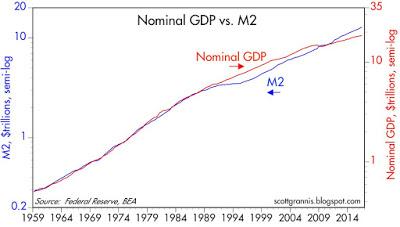

The chart above compares the level of M2 to the level of nominal GDP, with both measured the use of a semi-log scale. while the ratio of M2 to GDP has wobbled fairly a little bit through the years, over a length of well-nigh 60 years, both have elevated through essentially the same amount. (word that both y-axes are offset via an element of 1.seventy five.) This makes intuitive sense, seeing that the bigger the economy, the higher are incomes, and the more money is needed to make everything work. The gap on the appropriate-hand side of the chart means that there is about $2.three trillion of "further" M2 funds within the equipment, most of which is held in the sort of financial institution discount rates deposits, which now signify about two-thirds of M2, as in comparison to about 50% within the early 2000s.

In different words, americans are happily "hoarding" some $2.3 trillion of additional cash relative to their incomes, most of that in financial institution reductions deposits which pay almost nothing in the way of hobby. (That the general public is chuffed to grasp some $eight.6 trillion in financial institution savings deposits besides the fact that children that they pay practically nothing is a powerful illustration of simply how robust the demand for cash is.) should they lose the want to cling that funds, and judge in its place to spend it, nominal GDP might grow by as tons as $four trillion (2.three * 1.seventy five) if previous relationships had been to reestablish themselves. a whole lot of that growth would likely come in the form of better expenses, while some would come from superior actual growth - as a result of declining money demand, the flip aspect of rising self assurance, would possible go hand in hand with multiplied investment, which has been sore ly missing throughout this recuperation.

the following charts demonstrate that regardless of all of the trillions of bonds the Fed has bought, the sum of money within the financial system has now not grown any quicker beneath a QE regime than it has over the past six a long time:

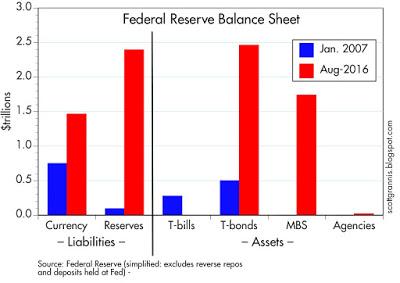

We delivery with the growth of the Fed's steadiness sheet, a simplified version of which is proven within the chart above. The blue bars characterize positions at first of 2007, neatly before the onset of the 2008 financial crisis and the launch of Quantitative Easing. The pink bars exhibit positions as of the Fed's latest file. thus, the era of Quantitative Easing, which all started in October 2008, saw the fed on internet purchase nearly $3 trillion of Treasuries and MBS. This resulted in a rise of about $2.four billion in financial institution reserves and an increase of about $600 billion in the amount of foreign money in circulation. (Banks can change their bank reserves for foreign money each time they want.)

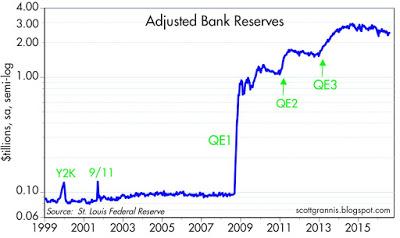

The chart above shows the growth of financial institution reserves, which grew from practically $100 billion in September 2008 to simply over $2.four trillion these days.

because of the enlargement of the funds deliver (which raises required reserves) and the modest shrinkage within the Fed's stability sheet over the past few years, extra bank reserves have declined by way of practically 20% seeing that their high two years ago. And the sky hasn't fallen.

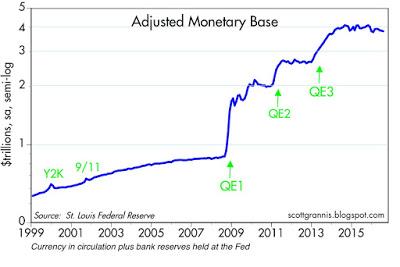

The monetary base, which is the sum of financial institution reserves and foreign money in circulation, and which in impact represents the high-powered cash that the Fed has created by the use of its purchases of notes and bonds, has accelerated from about $900 billion in September 2008 to just over $3.8 trillion today.

The Fed hugely extended its stability sheet and hugely grew the provide of reserves and high-powered money. but opposite to commonplace perception, there turned into no longer an identical explosion of increase within the cash supply. What came about became that banks had been chuffed to lend their deposit inflows to the Fed, instead of to the deepest sector. As I explained here, banks took in $four trillion of savings deposits and used that cash to buy notes and bonds which were in turn bought to the Fed in exchange for financial institution reserves. it is why Fed purchases didn't create massive quantities of new cash: banks were happy to boost their holdings of financial institution reserves.

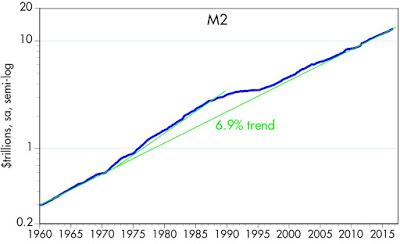

The chart above is the proof. For virtually six many years, the M2 cash deliver has grown at an annualized fee of 6.9%. all the way through the duration of Quantitative Easing, M2 grew at in regards to the equal rate as it has grown considering 1960.

searching more carefully, within the above chart, we can see that M2 has grown by using an annualized 6.5% seeing that early 2007 and on the grounds that QE begun in late 2008. A slower cost, definitely, than it has averaged considering that 1960.

The Fed's Quantitative Easing regime is extensively misunderstood. It become no longer about stimulus; it become as an alternative about pleasurable a good and unheard of raise in public's and the banking gadget's demand for safe, pastime-bearing property.

it will probably all conclusion in tears, if the demand for cash should decline and should the Fed fail to take timely and sufficient measures to offset the decline in banks' demand for excess reserves (by way of shrinking its steadiness sheet and/or raising the activity cost it can pay on excess reserves), but for now issues look adequate.

No comments:

Post a Comment